Contents:

Revenue per average customer/average sales transaction– Similar to average weekly sales, the average sales transaction refers to the average revenue per transaction. High average sales transactions can imply that the customer footfalls aren’t huge, but customers spend a lot more per transaction on average. This is generally true for high-end luxury restaurants.

Other concerns – Many barriers to entry and their effect on market competition like fast food chains enter into agreements that compel them to fulfill certain obligations, such as opening a certain number of outlets and/or franchises within a stipulated time. Contractual obligations of such a face may make the stock price volatile as they may constrain the company to take actions, which might not be in the best interest of its shareholders. Average weekly sales– Average weekly sales, also called average weekly net sales , refers to the average revenue a company generates in an operating week.

No, CNNE shares are not listed on NSE or BSE. Cannae Holdings, Inc. is listed on the NASDAQ stock exchange. The lowest CNNE stock price was $ 17.11 on 10th Apr 2023 within the past 52 weeks. Take your analysis to the next level with our full suite of features, known and used by millions throughout the trading world. Cannae Holdings, Inc. reported Q3 EPS of $0.69, $0.70 better than the analyst estimate of ($0.01). Revenue for the quarter came in at $164.5 million versus the consensus estimate of…

Cannae Holdings Inc (CNNE)

Store Additions – As mentioned above, restaurants grow their revenues by opening new stores. So, it’s vitally important to track their pace of new store additions as well. Generally, an increase in the number of stores/outlets indicates growth and is a positive sign for the company and its investors, since this increases future revenue potential for the company. It also signifies the company’s management and its board’s confidence in the restaurant chain and how it’s being operated.

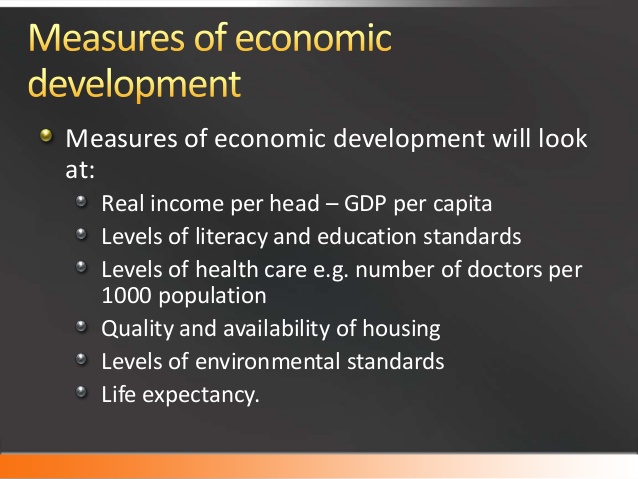

Revenue per employee generally indicates the efficiency of the company. The restaurant industry is one of the fastest-growing industries currently. As time is progressing, more people are eating out and contributing to this. Many companies like Chipotle Mexican Grill have announced that a significant number of restaurants that it opens this year will have drive-thru facilities. Since the pandemic is not going anywhere anytime soon, restaurants are adapting themselves to the new normal. Such drive-through and takeaway options will also encourage those people to eat out who would otherwise not prefer dining inside a restaurant.

Yes, you can buy fractional shares of Cannae Holdings, Inc. with Scripbox. Today, on 10th Apr 2023, the price of Cannae Holdings, Inc.

Cannae Holdings, Inc

I aspire to be a top-tier portfolio manager in the future. Another trend observed in this sector is the growing use of technology and innovation in and outside the kitchen. Companies like Starbucks doubled their unique customers within 2 years of their app launch. Online ordering has increased over the years. With the consequences related to the Covid-19 pandemic, this rate has increased rapidly. There is greater demand for home-delivered food, and people are switching from in-restaurant dining at an increasing pace.

https://1investing.in/ Holdings Inc share price live 19.01, this page displays NYSE CNNE stock exchange data. View the CNNE premarket stock price ahead of the market session or assess the after hours quote. Monitor the latest movements within the Cannae Holdings Inc real time stock price chart below. You can find more details by visiting the additional pages to view historical data, charts, latest news, analysis or visit the forum to view opinions on the CNNE quote. Business Quant is a comprehensive investment research platform that hosts most of the aforementioned data points.

Comparable Store Sales: Sales Growth Of Restaurants

The book value of a stock is theoretically the amount of money that would be paid to shareholders if the company was liquidated and paid off all of its liabilities. Other obligations– Companies often enter into contracts and agreements which may force them to operate in a certain way, that might not be desirable in the short run. Such contractual agreements must be kept in mind before you decide to invest in a company. World-class wealth management using science, data and technology, leveraged by our experience, and human touch.

- It also signifies the company’s management and its board’s confidence in the restaurant chain and how it’s being operated.

- The lowest CNNE stock price was $ 17.11 on 10th Apr 2023 within the past 52 weeks.

- Enterprise value includes in its calculation the market capitalization of a company but also short-term and long-term debt as well as any cash on the company’s balance sheet.

- Today, on 10th Apr 2023, the price of Cannae Holdings, Inc.

People have also started to choose health over taste. There is a rising demand for healthy and organic food options and unhealthy processed foods are losing widespread appeal. People also prefer restaurants that are eco-friendly as they consider it a step towards a healthier environment. Mutual Fund investments are subject to market risks.

An increase in the franchisees of the company may indicate that people and investors deem it profitable, successful and investable, hence more people are willing to run a business under the brand name. Franchise fees and royalties are a stable source of income for the restaurant chain, with minimal operating costs or capital expenditures involved. Comparable sales – Restaurants chains grow revenue by opening new stores and by expanding sales of their existing stores. The comparable sales figure tracks the latter — it encompasses sales from stores that already existed a year ago and doesn’t include the revenue contribution from new stores.

About Cannae Holdings, Inc

This item is an excellent and simple basis of comparison between companies in this industry. Higher AWS signifies increased sales volume and customer footfalls. Revenue – The revenue figure in the restaurant industry is slightly different from the aforementioned system sales. A restaurant chain’s revenue is the aggregate franchising fee that it earned from its franchises, in addition to the revenue that it earned from from its own company-owned stores. In this calculation, we leave out the revenue earned by its franchises.

Please read all scheme related documents carefully before investing. Past performance is not an indicator of future returns. Cannae Holdings, Inc. shares has a market capitalization of $ 1.466 B.

In the early stages of a startup restaurant chain, it may be difficult to decipher and predict whether the concerned company would close shop in a few years or would go on to become a successful story. Table turnover rate– Table turnover rate or table turn rate, is the average number of parties served per table. A higher turn rate can imply that the restaurant is serving more customers per table, hence maximizing its revenue per table. For companies with tight margins, the table turn rate should be more. It is calculated by dividing the number of groups served by the total number of tables.

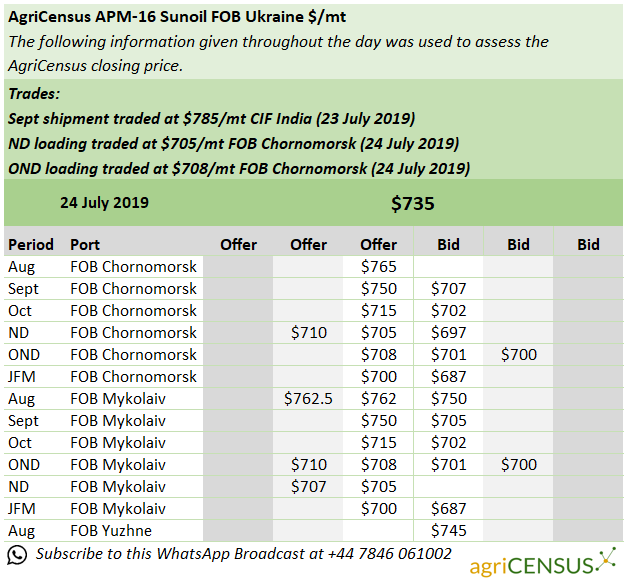

So, there’s a term called “system sales” which refers to the combined sales across all the operating outlets, be it company-owned or franchised stores. Tracking system sales helps in understanding how the entire restaurant chain is performing as a whole. If system sales are suffering, then it raises doubts on whether the brand is losing its relevance or competitive positioning in the market.

- So, there’s a term called “system sales” which refers to the combined sales across all the operating outlets, be it company-owned or franchised stores.

- System sales– Restaurant companies have a few different operating structures.

- Revenue per average customer/average sales transaction– Similar to average weekly sales, the average sales transaction refers to the average revenue per transaction.

- Since the pandemic is not going anywhere anytime soon, restaurants are adapting themselves to the new normal.

Difficulty in Profitability – Restaurants business is capital intensive in nature. From pre-opening costs down to their day-to-day activities, there are various kinds of capital expenditures and depreciation expenses involves. All these expenses can quickly rack up and weigh on their margins. Many newcomers and restaurant startups are unable to sustain the cost margin model in this industry and companies, generally, have to remain operational to break even and take advantage of unit economics. 99% of companies are not listed– The majority of the restaurants in this industry are not listed on the exchange. A major portion of the restaurant sector is owned by private companies or individuals, which makes it less regulated compared to other sectors like oil and gas.

Compass Diversified’s (NYSE:CODI) latest 3.3% decline adds to one-year losses, institutional investors may consider drastic measures – Simply Wall St

Compass Diversified’s (NYSE:CODI) latest 3.3% decline adds to one-year losses, institutional investors may consider drastic measures.

Posted: Sun, 05 Mar 2023 08:00:00 GMT [source]

Tracking this sector is also difficult because of this reason. Revenue per available seat hour– As the name suggests, it refers to the revenue as a multiple of the available seat hours. A restaurant may maximize its table turnover by opening for longer working hours. This metric normalizes this practice and provides an accurate picture of revenue per working hour. Enterprise Value is a measure of a company’s total value, often used as a more comprehensive alternative to equity market capitalization.

This reflects an accurate picture of the restaurant chain, since newly opened outlet generally aren’t profitable and lack the customer footfall in the initial days of operation. Also, comparable sales growth shows how much the company’s revenue from its existing store network is growing. System sales– Restaurant companies have a few different operating structures. These include having company-owned stores, franchised stores or a mix of both.