Content

- How taxes work on part-time self-employed income

- Worldwide and Domestic Revenues of PhRMA Member Firms

- Undergraduate Research Scholarships

- What Are Recent Trends in Spending for Prescription Drugs?

- Average Price of a Generic Prescription Drug Obtained Through Medicare Part D and Medicaid

- How to Use Stock Cards for Sales & Purchases

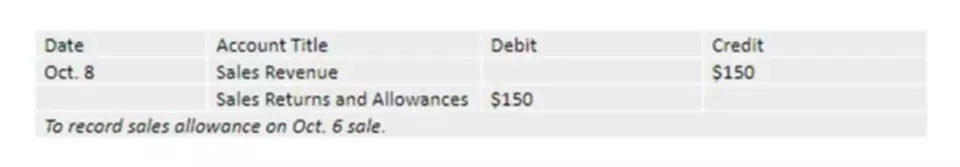

Additionally, federal regulatory policies that influence returns on drug R&D can bring about increases or decreases in both the supply of and demand for new drugs. If you are going to be recording sales and cash receipts manually in a journal, visit an office supply store. Look at the different column headings, and choose the one that best meets the needs of your business. Entries in your sales and cash receipts journal come from the source documents you use in your business every day. These documents are sales invoices, daily cash register totals, daily cash sheets and daily sales registers. The general ledger contains an accounts payable account, which is your accounts payable control account.

What is pharmacy database system?

The pharmacy management system, also known as the pharmacy information system, is a system that stores data and enables functionality that organizes and maintains the medication use process within pharmacies.

The cash disbursements journal has accounts payable credit and debit columns. Credit purchases and payments on account are entered in these two columns, respectively. At the end of the month they are totaled and posted to the control account in the general ledger. The beginning accounts receivable total, plus charge sales for the month, minus payments on account for the month, should equal the ending accounts receivable total. Compare this amount to the sum of the individual customer accounts receivable ledgers.

How taxes work on part-time self-employed income

The data in these series reflect the average price of generic prescriptions filled each year and exclude drugs that are administered in physicians’ offices or hospital settings. Likewise, Medicare’s minimum formulary requirements may contribute to higher net drug prices in that program. In addition to the requirement that Part D plans cover all drugs in the six protected classes, plans are also required to cover at least two drugs in all other therapeutic classes. Those requirements diminish the leverage that PBMs bring to their negotiations with manufacturers over drug prices for Part D plans.

Know exactly what products you have stocked with the Inventory Summary report. QuickBooks Online Plus and Advanced comes with a variety of reports to make inventory tracking easy. To further our understanding, we’ve included only the unit price of the goods, or how much an item costs per unit. Typically, we’d log the actual sale price in other accounts, but our focus pharmacy accounting here is solely on the stock card. Yes, effective January 1, 2005, gross receipts can be reported on a cash basis, provided that this is the method you report to the IRS. Large increases in funding for NIH—the locus of much of the federal government’s basic biomedical research support—in the late 1990s and early 2000s preceded a decade of declining funding.

Worldwide and Domestic Revenues of PhRMA Member Firms

If you don’t use a cash register, you can record cash receipts on a daily cash sheet and record sales on a columnar sales register. An accounts payable aging report is a good cash management tool that should be prepared periodically. If you use the accrual basis of accounting, as we recommend, expenses are recorded in the cash disbursements journal at the time the goods or services are paid for or in the purchase journal if you buy on credit. If you deal with a given supplier many times during the month, you don’t have to record every purchase. You could accumulate all bills for the month from that supplier, then record one transaction in the purchases journal at the end of the month. Tracking these revenue and expense lines separately can open a world of opportunity for monitoring the program with metrics.

- (As a result, drugs for chronic conditions typically sell in steady quantities.) Other such classes include new drugs with relatively small numbers of potential patients or shorter treatment durations but that have high prices per unit of treatment.

- The AMP is the average price paid to a manufacturer for a drug distributed to retail pharmacies, either through wholesalers or through sales directly from manufacturers to pharmacies.

- In the sample just described, companies spent an average of about $1,065 million in clinical trials per approved new drug (more than twice the amount spent in the preclinical research phase).

- Most office suites (such as Microsoft Office or OpenOffice.org) contain a number of invoice templates that may be used as a starting point to design your own sales invoice.

- One of the most notable technology trends 2022 saw was the shift in supply availability and how pharmacies and retailers had to operate to ensure they had the needed stock.

Differences in average spending among enrollees in Medicare and Medicaid and the nation as a whole most likely stemmed from differences in the health profiles of their respective patient populations and statutory rebates in the Medicaid program. First, it increases demand for prescription drugs, which encourages new drug development, by fully or partially subsidizing the purchase of prescription drugs through a variety of federal programs (including Medicare and Medicaid) and by providing tax preferences for employment-based health insurance. Markets for prescription drugs purchased at pharmacies in the United States are served by a complex supply chain, with payment flows involving multiple actors, including intermediaries (such as pharmacy benefit managers, or PBMs, which negotiate prices but do not distribute or dispense the products). The supply process begins with pharmaceutical manufacturers selling their output to wholesale distributors. The distributors resell those drugs to pharmacies, at prices that may have been negotiated by group-purchasing organizations on behalf of members, including pharmacies.

Undergraduate Research Scholarships

There are numerous reasons why a business might record transactions using a cash book instead of a cash account. Mistakes can be detected easily through verification, and entries are kept up to date, as the balance is verified daily. By contrast, balances in cash accounts are commonly reconciled at the end of the month after the issuance of the monthly bank statement. Demand for new ways to bring customers back into stores made customer loyalty one of the top technology trends in 2022. Retail pharmacies needed the ability to draw in their customers by running unique and flexible promotions, in addition to fostering a loyalty program that targeted customer interest.

Then the CE (Covered Entity, aka the clinic) will pay the pharmacy store back by re-ordering inventory, at 340B discount price, to replenish the pharmacy’s stock. The pharmacy and TPA manage those purchase orders too, which are made on a wholesale account in the clinic’s name, and the bill is sent to the clinic When inventory is restocked, the https://www.bookstime.com/ store in turn will pay the clinic for the sales (less fees). In short, the clinic has to pay them back for the inventory we used before they pass along the proceeds. Currently under LAMC Section 21.00, taxpayers are required to report their gross receipts using the accrual accounting method including any bad debts that are never collected.

What Are Recent Trends in Spending for Prescription Drugs?

These solutions utilize sophisticated calculations to assess information such as historical orders, inventory on hand, seasonality, next order date, and lead time to inform managers of an accurate assessment of when they should order next, with automated reordering when stock gets too low. When paired with vendor management software, your POS system becomes a keystone for your managers to keep track of inventory, incoming orders, and vendors in one place. Over the past 2 years, Marco and Diana had begun to gain an appreciation for the need to track the use of money. Not only was he successfully paying off his loans, he was actually beginning to save some money for his future.

- See Congressional Budget Office, How Taxes Affect the Incentive to Invest in New Intangible Assets (November 2018), /publication/54648.

- That’s because self-employed work is essentially taxed at a flat 15.3% rate, on top of any income taxes.

- MCOs represent a mix of private for-profit, private non-profit, and government plans.

- In fact, most start by outsourcing manufacturing or sourcing to third parties.

- Generic drugs often require the lowest amount of cost sharing, whereas very expensive drugs or those for which plans have negotiated smaller rebates tend to have higher cost-sharing requirements.

- David Austin and Tamara Hayford prepared the report with guidance from Joseph Kile, Lyle Nelson, and Julie Topoleski.

The cash disbursement journal would include items such as payments made to vendors to reduce accounts payable, and the cash receipts journal would include items such as payments made by customers on outstanding accounts receivable or cash sales. States use an array of financial incentives to improve quality including linking performance bonuses or penalties, capitation withholds, or value-based state-directed payments to quality measures. About one-quarter of MCO states reported at least one MCO financial incentive tied to a health equity-related performance goal (e.g., reducing disparities by race/ethnicity, gender, disability status, etc.) in place in FY 2022. In addition to financial incentives, states can leverage managed care contracts in other ways to promote health equity-related goals (Figure 13).

Average Price of a Generic Prescription Drug Obtained Through Medicare Part D and Medicaid

Since 1980, the share of nationwide spending on health care services overall that can be attributed to prescription drugs has nearly doubled, from about 5 percent to almost 10 percent in 2018. Through the 1980s and early 1990s, 5 percent to 6 percent of all spending on health care services and supplies was on prescription drugs obtained in the retail market (that is, from pharmacies—either in stores or by mail order). In comparison, the share of spending on health care services and supplies that was attributable to hospital services fell from 40 percent in 1980 to 31 percent in 2018, and the share attributable to services provided by medical professionals and in clinical settings was about 20 percent over that period. In FY 2021, state and federal spending on Medicaid services totaled over $728 billion. Payments made to MCOs accounted for about 52% of total Medicaid spending (Figure 4), an increase of three percentage points from the previous fiscal year. The share of Medicaid spending on MCOs varies by state, but over three-quarters of MCO states directed at least 40% of total Medicaid dollars to payments to MCOs (Figure 5).

Pharmacies package the drugs into prescriptions and sell them a third time, to consumers. As a result, the concept of “price” differs depending on the entity that is receiving payment—or paying—for a prescription. Developing new drugs is a costly and uncertain process, and many potential drugs never make it to market. Only about 12 percent of drugs entering clinical trials are ultimately approved for introduction by the FDA. In recent studies, estimates of the average R&D cost per new drug range from less than $1 billion to more than $2 billion per drug. Those estimates also include the company’s capital costs—the value of other forgone investments—incurred during the R&D process.