Contents:

It is a type of costing used to figure out how much it costs a business to manufacture a small batch of unique items for a customer. Some examples include personalized t-shirts for a team, props used for filmmaking, or law firms calculating what to charge clients. Most businesses create annual budgets that include estimated overhead and estimated activity for the year. You can use these budget estimates to calculate an overhead rate to apply to each of your jobs. The first step is to identify the job and its requirements.This is done by analyzing the factors and outcomes which will be affected by taking up this job. This is a very essential step because it helps you decide on an estimate for the job that you will be undertaking.

Both methods have advantages and disadvantages; choosing the method depends on the company’s specific needs. Job costing is a costing method used to determine the cost of specific jobs, which are performed according to the customer’s specifications. It is a basic costing method which is applicable where work consists of separate projects or contract jobs.

Therefore, someone allocating costs to a specific job must know of it. Cost CenterCost center refers to the company’s departments that don’t contribute directly to the corporate revenue; however, the firm has to incur expenses for keeping such units operative. It comprises research and development, accounting and human resource departments.

Inaccurate cost allocation can significantly challenge job-order costing. The resulting cost data can be reliable if costs are accurately assigned to each job or batch; otherwise, the resulting cost data can be unreliable. This can lead to incorrect pricing strategies, inefficient production processes, and lower profitability. By tracking costs at the job or batch level, manufacturing companies can identify areas where they can improve efficiency and reduce costs. This can lead to more streamlined production processes and higher profitability.

Definition of Job Order Costing

Retail Companies – It takes a lot more than having the product on hand to run a retail business. Retailers need to factor in warehouse rent, staff wages, IT and website developers, advertising costs, and many other costs involved that require consistent monitoring to remain profitable. Calculating the costs before taking on a new contract can ensure you do not negotiate for payment that is too little, which will affect your future profitability.

A Tiny Blog Took on Big Surveillance in China—and Won – WIRED

A Tiny Blog Took on Big Surveillance in China—and Won.

Posted: Tue, 04 Apr 2023 07:00:00 GMT [source]

Cost Codes are used for each phase, allowing “mini-budgets” to be generated and tracked. In the construction industry, the Construction Specifications Institute has established an industry standard Cost Coding system. The job costing system consists of various cost drivers that drive job costs. Download this free job cost sheet to help you track the direct and indirect costs of individual projects and jobs. While job-order costing has many advantages, it also comes with its fair share of challenges, including accurate record-keeping, cost allocation, and estimating overhead costs.

Why Is Accurate Job Costing Important?

net terms can also use this information to forecast production costs and plan for future capacity needs. Accounting is also responsible for ensuring that the cost data is properly allocated to the appropriate financial accounts, such as inventory, cost of goods sold, and accounts payable. This information is used to prepare financial statements that accurately reflect the cost of production and the company’s profitability. Accounting is critical in job-order costing, as it tracks and reports on the cost data for each job or batch. If you provide a variety of services, which ones are your most and least profitable?

Failure to include these costs in the cost of production can lead to inaccurate pricing decisions and profitability analyses. Printing companies that produce custom-made printed materials, such as business cards, invitations, and brochures, can benefit from job-order costing. Construction companies that undertake projects contractually can benefit from job-order costing. Each project requires specific materials, labor, and equipment, making it easier to track the cost of each job and allocate overhead expenses. In a job costing environment, non-direct costs are accumulated into one or more overhead cost pools, from which you allocate costs to open jobs based upon some measure of cost usage. The key issues when applying overhead are to consistently charge the same types of costs to overhead in all reporting periods and to consistently apply these costs to jobs.

Cost Accounting: What It Is And When To Use It – Forbes

Cost Accounting: What It Is And When To Use It.

Posted: Thu, 18 Aug 2022 07:00:00 GMT [source]

The accurate cost information is not obtained since large number of small jobs is executed at a time in job costing. There is no possibility of control of costs since the controlling steps are taken only after incurring the expenses in job costing. Control of costs, by comparing actual costs with estimated costs, is also one of the objectives of job costing. Another objective of job costing is to provide a basis for estimating or determining the cost of similar jobs undertaken in future. Allocate the variance to those jobs that were open during the reporting period.

Selling Price of the Job

All other manufacturing-related labour is recorded in an overhead cost pool and is then allocated to the various open jobs. The first type of labour is called direct labour, and the second type is known as indirect labour. Job costing, generally, means a specific accounting methodology used to track the expense of creating a unique product. Job costing forms have spaces to include direct labor, direct materials, and overhead.

Grand National: More than 100 arrests as protesters attempt to invade course – AOL

Grand National: More than 100 arrests as protesters attempt to invade course.

Posted: Sun, 16 Apr 2023 03:30:00 GMT [source]

This includes the cost of the materials used to make the product, such as wood, metal, or plastic. To calculate the material cost, determine the material used and the cost per unit. Multiply the cost per unit of material by the quantity used to get the total cost.

This form provides essential documentation to track inventory. It also reveals that the “direct material” for the billboard task was $150 . The wire nuts and tape that might have been used on the billboard will be dealt with as overhead, which is discussed later. Manufacturing Overhead includes the costs of work in progress B, the overhead for depreciation, utilities and insurance, and the sales commissions expenses. From the total of $ 952,000, accountant deducts the cost of work in progress A and work in progress B.

What are the advantages and disadvantages of a job costing system?

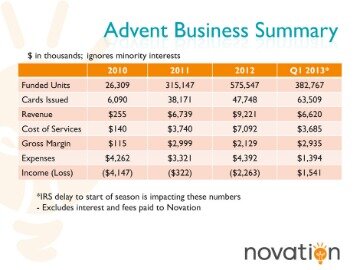

This information is vital for determining pricing strategies and profitability. A job order costing model best suits manufacturing companies that produce products in limited production runs. The cost of production is spread over a smaller number of units, making it difficult to allocate overhead expenses accurately.

- Job costing, generally, means a specific accounting methodology used to track the expense of creating a unique product.

- Shipping, auditing, maintenance and repair, installation, and any industry which creates products unique to each need.

- However, it is a known fact that whenever any organization thinks of having an efficient mechanism, they have to bear the cost for the same.

- Job-order costing allows manufacturing companies to provide more accurate pricing estimates to customers.

- The accountant shares that job costing will be, probably, the most efficient accounting methodology.

In either case, the form will instead include a part or serial number. A subsequent clerical task will be to identify the cost of the particular parts that were put into production. In that preliminary presentation, most cost data (e.g., ending work in process inventory, etc.) were “given.” Chapter 18 showed how cost data are used in making important business decisions. How does one determine the cost data for products and services that are the end result of productive processes? Advertising Firms – Marketing and advertising costs may include rent, office supplies, computer software, utilities, internet services, and much more. Factoring the actual costs of the job into their prices will determine how much they charge to run an advertising campaign with a client.

Finally, a percentage of profit is added with total cost to estimate the price for job and tendered to the customer. The extent of percentage of profit is the policy matter of the management. This type of estimation is highly useful for submission of tenders and quotations.

This information is crucial in determining the selling price of the product and making informed decisions about pricing and profitability. The company has several indirect expenses incurred in the production process, including rent, utilities, insurance, and depreciation of machinery and equipment. The company estimates the total manufacturing overhead cost for the entire job will be $900.

Connecting with the science community on many levels, he has enjoyed his career. He has since started a company which provides maintenance work on historical works which reside in museums. Work in progress at any time depends on the number of jobs in hand at that time. A separate work in progress record is maintained for each job. The products are produced only against customer’s order and not for maintaining stock for sale. The debits and credits that are needed to track the accumulation and application of costs within a company’s general ledger system.

Tracking Labor

Once the cost data is collected, accounting is responsible for analyzing the data and preparing reports that summarize the cost information for each job or batch. These reports provide critical information for management decision-making, including determining the profitability of each product line and identifying areas for cost reduction. This latest job costing software allows you to report accurately on profitability per project.

With job-order costing, manufacturing companies can control their costs more effectively by identifying inefficiencies and waste in production. By tracking costs at the job or batch level, companies can determine which jobs are profitable and which are not and adjust accordingly. Job-order costing in manufacturing refers to a cost accounting method where the production costs are accumulated and assigned to a specific job or batch of products. As a manufacturing company, accurately determining the cost of production for each job or order is essential for profitability and success.

Using spreadsheets or other manual tracking methods can result in data entry errors, leading to inaccurate cost data and incorrect decision-making. Implementing a job-order costing system can be expensive, particularly for small manufacturing companies that may need more financial resources to invest in this process. The cost of software and training can also be a barrier to implementation. The main objective of job costing is to ascertain the cost as well as the profit or loss on each job. With the help of the job order costing method, management can ascertain which job is profitable and which is not. Examples include rent payable, utilities payable, insurance payable, salaries payable to office staff, office supplies, etc.

Process costing is most often used by companies mass producing many identical or near-identical products at once. Take the example of a construction company hired to build a high-rise for a real-estate developer. Depending on the terms of the contract, the builder may share these details with clients so they can see the breakdown of costs. Additionally, in the future, the construction company can better quote and plan for similar projects armed with specific, real-world examples. Job Costing, as the name implies, allows companies to track the revenues and costs of each job. Job costing systems record revenues and costs for unique units of product that can be easily distinguished from other units of the product.

By using job-order costing, the company can track the cost of each production run and allocate overhead expenses, making it easier to calculate the cost of production accurately. Job-order costing is suitable for manufacturing companies that produce products in varying production runs. Each production run requires different materials, labor, and overhead expenses. It delivers the most value when project accounting software for professional services is integrated with other modules as part of a comprehensive ERP solution. These modules can include human resources, inventory planning, customer relationship management and more. Together in one digital space, these solutions deliver more comprehensive visibility and control over projects across the business, in real time.

Job costing method foster the activity of delegation of duties amongst the employees. Factory job costing is entails undertaking a client’s assignment or job in a factory. The focus is the assignment at hand and on its completion, the output is delivered to the client. Contract costing method is also known as terminal costing method and it involves doing some assignment with set specification for another person for a payment. The contract costing method of ascertaining cost for a contract.

The company may need to invest in new software or equipment, hire additional staff, or provide training to existing staff. The company must hire workers to produce the chairs and dining table. The company estimates it will take 60 hours to complete the job, with each chair taking 6 hours to make and the dining table taking 30 hours to make. Therefore, the total direct labor cost will be $1,200 (60 hours x $20). Job-order costing can be a complex process that requires significant time and resources to implement and maintain. Tracking costs at the job or batch level can be challenging, particularly for companies producing a large volume of products.

- When the job to be executed requires special treatment, a design to meet the customer’s specifications is prepared by the production planning department.

- Access your Strategic Pricing Model Execution Plan in SCFO Lab.

- For example, Roy was once the curator of a large museum in the United States.

You can see where the money is going for construction work to predict future costs more accurately. The main purpose of job costing is to determine the profit or loss on each job. The estimated costs are recorded in the job cost sheet and the actual incurred costs are also collected for each job separately. Then, a comparison of actual cost is made with the estimated cost in respect of each job to know the level of profit.